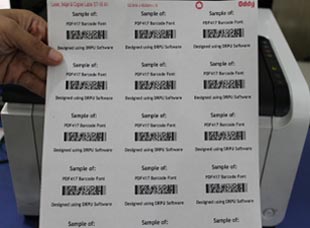

The banking sector is an organization and a part of the economy dedicated to protecting capital assets for everyone and utilising those assets to produce more revenue. This category includes government control of banking activities, security, mortgages, market opportunities, and credit cards. A variety of fraud categories faced by financial industry includes cheque fraud, bill discounting fraud, phishing or internet fraud, and so on. Barcodes are used in finance, loans, investments, and security documents. Putting barcode sticker sheets in front of records allows you to continue preparing them while they're being gathered.

What is a banking fraud?

Accounting fraud is an effort to harm a commercial or corporate finance institution with currency or other assets. This can range from data theft, hacking, and basic bookkeeping modification to falsified documents. Criminal invasion of privacy and mismanagement of funds, payments done fraudulently through copied methods, manipulation of balance sheets, irregularities in international transactions, unauthorized credit facilities extended for illegal fulfilment, cheating and spoofing, irresponsibility, and cash shortages are some of the categories they fall into.

What are the different types of frauds in banking sector?

There's a lot of room for misunderstanding with new payment methods

The emergence of smart phones with internet and many forms of payment through applications has created an enabling atmosphere for fraud. While UPI and card payments have secure access, fraudsters employ a variety of tactics to try and convince customers to disclose sensitive information. Tricksters utilise a variety of methods, including payment requests via the Unified Payments Interface (UPI) and QR code sharing via WhatsApp.

Fraudulent Credit Card Transactions

The most common type of financial fraud is credit card fraud, which includes card duplication, this fraud type rising day by day and most people became victims of this scam in recent years. Credit card fraud is a common method of stealing from banks, businesses, and customers. These cards are a certain size and include a lot of information imprinted on them. However, credit card may used by fraudster in different ways.

- Authentic cards are modified.

- Duplicate cards are made in a variety of ways.

- Credit cards are used in illegal advertising.

- Genuine cards are obtained and used after a fraudulent application is submitted in the name/address of another individual.

Money-laundering request

Request money scams is a method of tricking individuals and obtaining their money through the use of a payment request. Counterfeiters take use of UPI's request functionality by making falsified payment requests that include messages such as "Type the UPI PIN to get cash", "Transaction successful collect Rs. xyz," and so on. Only while transferring money you need to enter your PIN.

To receive money, do not: 'Pay' or input your UPI pin.

False QR Codes

Because QR codes are often used for scanning and payment, we've seen cases when fraudsters mislead individuals into thinking they're getting a deposit confirmation. Fraudsters send a QR code to their victims over WhatsApp, instructing them to scan the code to collect money. This QR code, which may be found in some UPI apps, is a collect request, and scanning and inputting your PIN complies with it. To remind you once again scan QR code to make payments only.

- Don't give anyone your card number, expiration date, PIN, or OTP.

- When making a payment with QR codes, pay special attention to the information displayed before confirming the transaction.

- Only use QR code payments in situations that you feel to be normal. Don't be pressured or persuaded to pay in a method you're unfamiliar with.

- Treat a QR code the same way you would any other link. If you don't know where it came from or if you don't trust the source, don't follow it.

- If you scan a code and get on a page that requests personal information such as your name, login credentials, address, and so on, don't enter it.

App for remote access

Users are asked to download screen-sharing programmes such as Screen share, any desk, and team viewer, which are then used to get access to bank information. These apps aren't malicious, but they do provide a third party access to your mobile data.

Not at all: To enable/receive payments, do not download third-party programs such as Screen sharing, any desk, and Team viewer.